research

submitted

-

Robust portfolio allocation under dependence uncertaintyEric André, and Bertrand TavinDec 2023

Robust portfolio allocation under dependence uncertaintyEric André, and Bertrand TavinDec 2023In this paper, we present a solution to the problem of robust portfolio allocation for an investor facing uncertainty with respect to the dependence between risky assets’ returns. We use the Multiplier Preferences framework to build a decision criterion which is robust to this uncertainty and we use copulas to model general dependence structures without additional assumptions. We study the properties of this robust portfolio allocation problem and prove the existence and unicity of its solution. Then, using Bernstein copulas, we devise a solvable approximate version. We prove the existence and unicity of the solution to the approximate problem. We then prove the convergence of the approximate solution to the exact solution when the discretization gets finer. In a numerical study, we provide comparative statics of the relationship between the level of ambiguity aversion and the robust allocations. We find that our robust portfolios are less diversified compared to the standard max-expected utility or maximum Sharpe ratio portfolios. The magnitude of this effect is driven by the level of ambiguity aversion of the considered agent. Finally, in a simulation study, we evidence the robustness of the obtained portfolios against the discovery of the true dependence model.

work in progress

-

Home Bias and Learning in a Dynamic Portfolio Choice under Smooth AmbiguityEric André, and Silvia Faroni

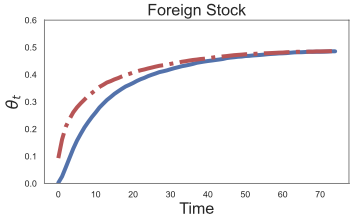

Home Bias and Learning in a Dynamic Portfolio Choice under Smooth AmbiguityEric André, and Silvia FaroniWe study the home bias in a dynamic consumption and portfolio choice problem where the in- vestor is ambiguous about stock returns but learn about their distributions. The investor’s preference is modeled with the generalized recursive smooth ambiguity model of Ju and Miao (2012) that is able to separate among risk aversion, ambiguity aversion, and intertemporal substitution. To solve this problem, we develop a numerical approach which extends the existing ones to tackle the specificities of our framework. Our results show that ambiguity averse investors participate less in financial mar- kets and have a higher home bias compared to ambiguity neutral decision makers. However, learning increases market participation and reduces the home bias which does not disappear due to the finite investment horizon. We finally provide comparative statics for risk aversion, ambiguity aversion and the learning process.

working papers

-

Ambiguity in Factor Models with Vector Expected UtilityEric AndréJan 2023

Ambiguity in Factor Models with Vector Expected UtilityEric AndréJan 2023This letter applies Siniscalchi (2009)’s Vector Expected Utility to introduce ambiguity aversion into factor models for assets’ returns. The resulting criterion is tractable and its adjustment for ambiguity vanishes as initial wealth increases. Finally, it can be related to shrinkage estimators which are used to estimate covariance matrices.

-

A Bayesian Application of the Variational Preferences to Optimal Portfolio ChoiceEric AndréJul 2022

A Bayesian Application of the Variational Preferences to Optimal Portfolio ChoiceEric AndréJul 2022This letter develops a decision criterion which takes into account parameter and model uncertainty in an optimal portfolio choice problem. This criterion is a special case of the Variational Preferences, rewritten in the Bayesian statistics notations, which specifically exploits the information contained in an observed sample of assets’ returns. I provide an example to illustrate its properties and to highlight its differences with the closely related Multiplier Preferences.

-

Factor Investing with Reinforcement LearningEric André, and Guillaume CoqueretMay 2022

Factor Investing with Reinforcement LearningEric André, and Guillaume CoqueretMay 2022This article aims to enhance factor investing with reinforcement learning (RL) techniques. The agent learns through sequential random allocations which rely on firms’ characteristics. Using Dirichlet distributions as the driving policy, we derive closed forms for the policy gradients and analytical properties of the performance measure. This enables the implementation of REINFORCE methods, which we test on a large dataset of US equities. Across a large range of parametric choices, our result indicates that RL-based portfolios are very close to the equally-weighted (1/N) allocation. This implies that the agent learns to be agnostic with regard to factors, which can partly be explained by cross-sectional regressions showing a strong time variation in the relationship between returns and firm characteristics. All in all, our results contribute to a nascent stream of literature that relativizes the usefulness of mainstream characteristics in asset pricing models.

-

Optimal Insurance for Prudent Risk Averters and Risk LoversEric André, Olivier Le Courtois, and Xiaoshan SuJan 2020Harold D. Skipper Award for the best paper presented at the Asia-Pacific Risk and Insurance Association Meeting 2019.

Optimal Insurance for Prudent Risk Averters and Risk LoversEric André, Olivier Le Courtois, and Xiaoshan SuJan 2020Harold D. Skipper Award for the best paper presented at the Asia-Pacific Risk and Insurance Association Meeting 2019.This paper examines the structure of optimal insurance contracts for a broad class of insureds that includes both risk averters and risk lovers and by assuming that the insureds are prudent. We specify the difference in optimal contract form between risk averters and risk lovers. Treating these decision-makers as a unique group, we show that the optimal insurance form is dual limited stop-loss insurance with an upper limit, which implies that including risk lovers in the group of decision-makers changes the contract in the small loss part. We also consider the situation of contracts with a concave payoff, where the optimal contract form becomes limited change-loss insurance or limited dual change-loss insurance depending on the coefficient of variation of the retained loss. Finally, we derive the form of optimal contracts in the presence of a background risk.